Home loan yearly interest calculator

The intricacies of the amortization schedule - yearly or monthly can be understood by simply contacting us. This calculator compares a home loan without an offset account to a loan linked with an offset account.

Advanced Loan Calculator

This compounding interest calculator shows how compounding can boost your savings over time.

. Keep an eye on that too while looking for a loan. The interest and principal paid the remaining balance and the total interest paid by the end of each month are computed. Home Loan Repayments Home loan repayment and total interest paid are calculated using the information selected and are an indicative estimation.

Quickly see how much interest you will pay and your principal balances. The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. When home loan interest rates are higher than savings account and term deposit interest rates your interest saved would be higher than the interest youd earn.

Loan APR is a more complete measure that reflects the net effective cost of your loan on a yearly basis. The date of which your monthly payment is due. The calculator divides your annual property taxes by 12 to calculate this monthly amount.

Compare multiple home loan products by various banks by using this method. Interest Rate which may fluctuate. How much youll pay each month toward your loan balance and interest charges.

The total amount youll pay each month and the figure the lender will use to qualify you for loan approval. You can calculate based on daily monthly or yearly compounding. 30-Year Fixed Mortgage Principal Loan Amount.

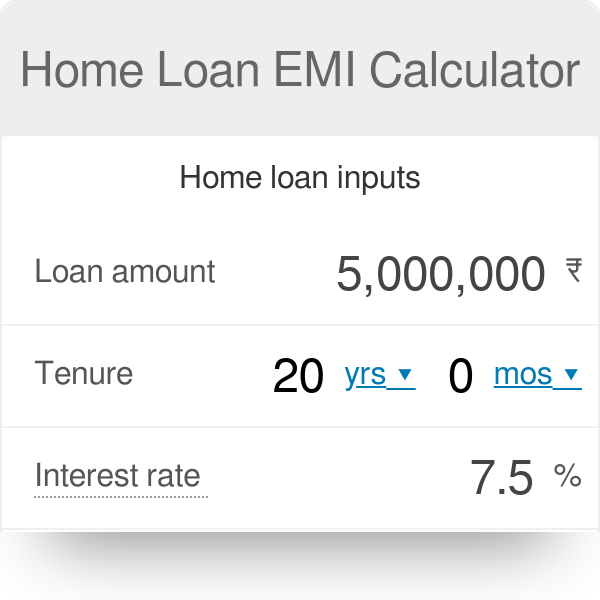

Factors that affect your home loan eligibility Your age. Your age is one of the main factors determining your home loan eligibility and it may affect your monthly payment and interest rate for the given loan amount. The home loan calculator uses the following parameters.

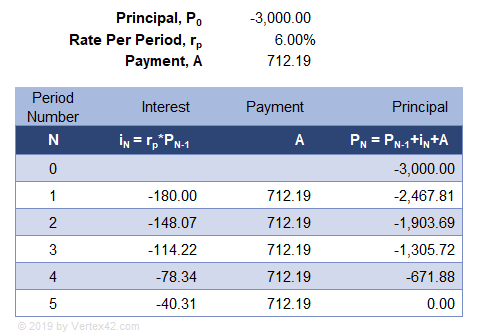

Use a home loan EMI calculator and calculate your EMI based on these factors. Let us take another example of Smith who has borrowed a sum of 5000 from XYZ Bank Ltd for a period of 3 years. The interest and repayments may vary due too.

The following example shows how much time and money you can save when you make a 13 th mortgage payment every year starting from the first year of your loan. Calculate the interest on a loan to be paid by Smith at the end of 1 st year 2 nd year and 3 rd year. Home equity loan calculator.

You can even determine the impact of any principal prepayments. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Tax deductions are not the same as credits.

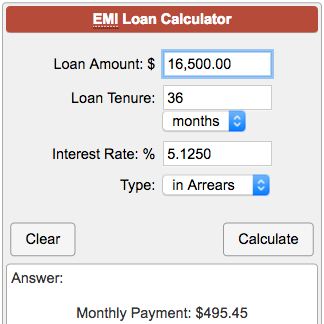

The rate of interest charged for the facility is 8 and the loan has to be repaid in 6 equal half-yearly payments of 954. Loan APR which is expressed as a yearly percentage rate represents the true cost of your loan after taking into account the loan interest rate plus the fees charges that you pay when getting a loan. Repayment Type Principal Interest or Interest Only.

What does the Output Page of this EMI Calculator show. Home financial fha loan calculator. In the past homeowners were able to deduct interest paid on up to 100000 of home equity loan debt for any reason but the 2018 tax law no longer allows the deduction of interest paid on HELOCs and home equity debt unless it is obtained to build or substantially improve the homeowners dwelling.

If you are young you may opt for a long loan tenure and get a loan with a lower EMI and low home loan interest rate. Press the report button for a full amortization schedule either by year or by month. Free FHA loan calculator to find the monthly payment total interest and amortization details of an FHA loan or learn more about FHA loans.

Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule. Your monthly income will influence. The monthly payment and.

Also certain lenders roll out home loan offers with reduced interest rates from time to time. This home loan calculator gives the following information on the output page. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or.

You can also use the calculator on top to estimate extra payments you make once a year. The Home Loan EMI Calculator uses an algorithm that takes into account variables such as your home loan amount the interest rate and the tenure of your loan. The output page displays the monthly EMI amount on top.

Mortgage Repayment Calculator Australia Use this calculator to generate an amortization schedule for your current mortgage. Also know your requirements first before applying. Hence better chance to avail a home loan.

Yes complete amortization table. Apply for Home Loan with Low Interest Rates Starting at 665 pa. We multiply your PI monthly amount by 12 to get a yearly value then.

Add other incomes - yearly bonus rent from property FD interest. Browse through the types of housing loans available and choose the one that best suits your needs. A break-up of the total amount payable is shown below which provides the details of the loan amount the interest due and the total amount payable.

Remember to show proof of these incomes as well. Interest paid by the end of each year are calculated.

Excel Formula Estimate Mortgage Payment Exceljet

Compound Interest Calculator For Excel

How Can I Calculate Compounding Interest On A Loan In Excel

Excel Formula Calculate Loan Interest In Given Year Exceljet

Free Interest Only Loan Calculator For Excel

Compound Interest Calculator For Excel

Simple Interest Loan Calculator How It Works

Simple Loan Calculator

Interest Only Calculator

How Can I Calculate Compounding Interest On A Loan In Excel

Interest Only Mortgage Calculator

Full Function Mortgage Calculator Interest Co Nz

Loan Interest Calculator How Much Will I Pay In Interest

Home Loan Emi Calculator

Mortgage Calculator How Much Monthly Payments Will Cost

Emi Loan Calculator

How To Calculate Loan Payments Using The Pmt Function In Excel Youtube